CAYMAN ISLANDS AUTOMATED CLEARING HOUSE (CIACH)

ACH (Cayman) Limited was established in 2017 to plan and implement the Cayman Islands Automated Clearing House (CIACH). CIACH is an electronic payment and cheque imaging system that is shared by participating banks in the Cayman Islands.

ACH (Cayman) Limited is jointly owned by the six class A retail banks: Butterfield Bank (Cayman) Limited, Cayman National Bank Ltd., CIBC FirstCaribbean International Bank (Cayman) Limited, Fidelity Bank (Cayman) Limited, RBC Royal Bank (Cayman) Limited and Scotiabank & Trust (Cayman) Limited.

Purpose

The CIACH is designed to clear and settle electronic transactions and provide a secure, cost-efficient exchange and settlement mechanism for domestic payments in KYD and USD currencies that adheres to international standards.

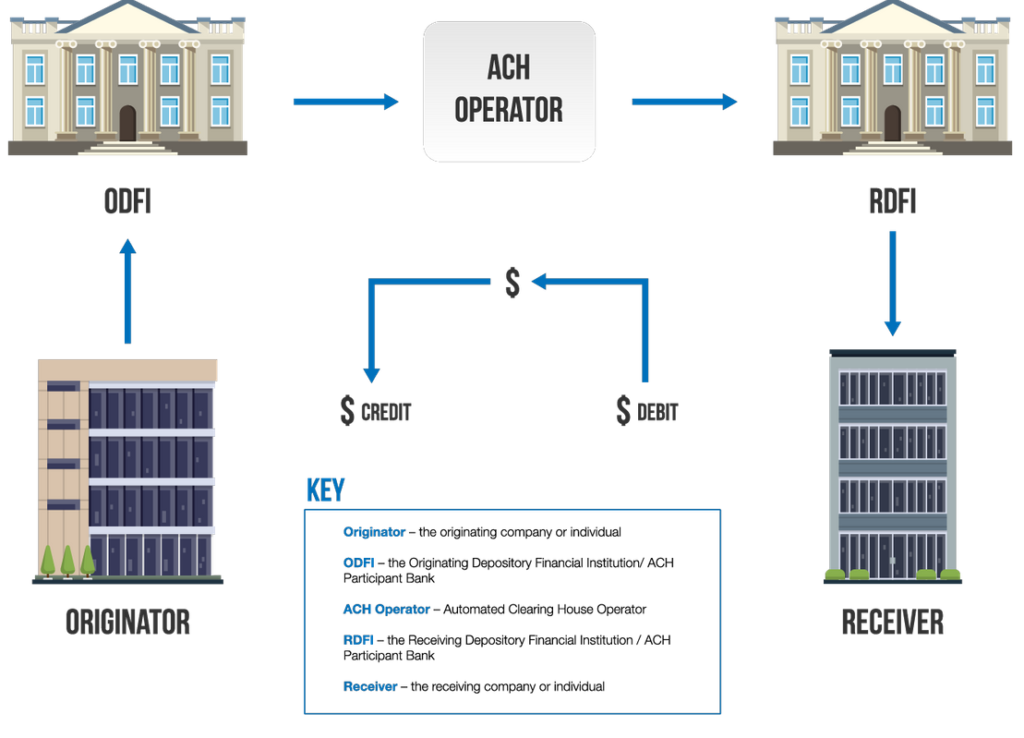

About Electronic Funds Transfer (EFT)

The Cayman Islands Automated Clearing House (CIACH) adopted a phased approach to implementation. The first phase brought the introduction of Electronic Fund Transfer (EFT). EFT’s facilitate the electronic movement of direct debit and credit transactions in both Cayman Islands dollars and United States dollars, to personal and corporate accounts held in the Cayman Islands.

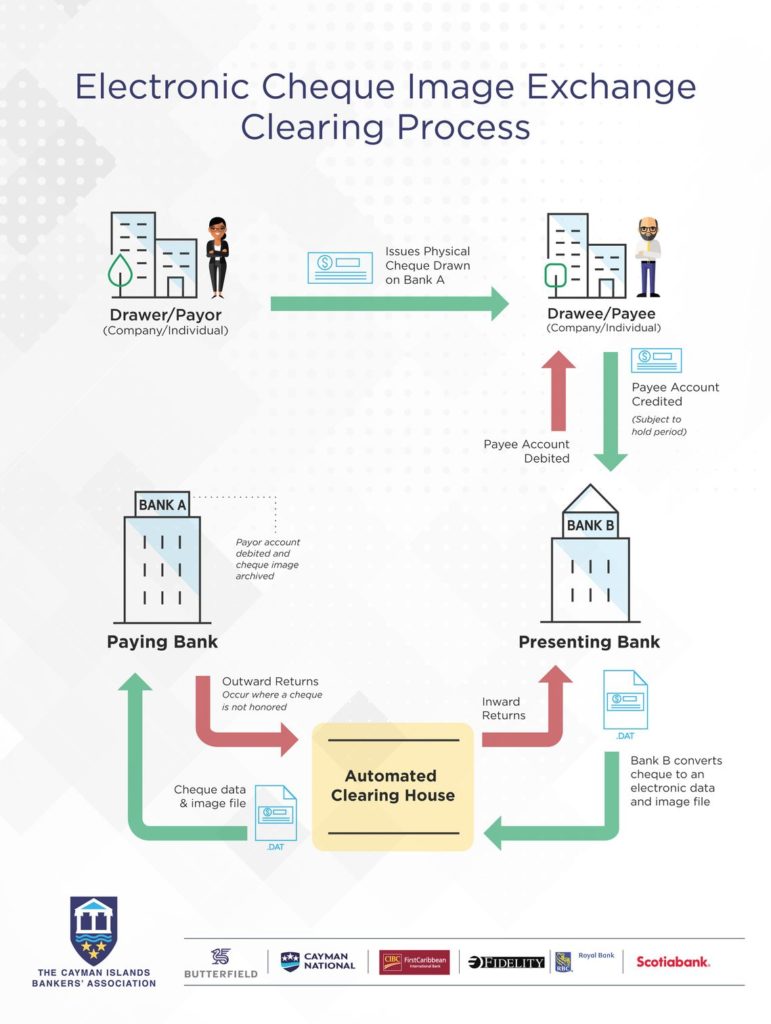

About Electronic Cheque Image Exchange

The Cayman Islands Automated Clearing House (CIACH) has adopted a phased approach to the implementation of its new payment services. The second phase saw the introduction of an Electronic Cheque Image Exchange which facilitated the electronic exchange of cheque images, improving the speed with which interbank cheque transactions, in both Cayman Islands dollars and United States dollars drawn against local banks, are settled.

For additional details regarding the latest cheque layout standards, contact your bank directly. You can also visit our FAQs for more information.